Every hour of every day, a government facility in Washington D.C. turns paper into money. In order to keep up with demand, these machines are running 24/7, pumping more than 500 million dollars into the US economy every day.

But this is only a tiny fraction of how much money is really made. Most of our money exists digitally, and this number currently goes up by more than 4 billion dollars every day. But where does all of this money come from? And where does it go once it’s created?

Before it ever reached your bank account, it changed hands countless times, passing through people, governments and businesses, all after being simply typed into existence on a computer.

We modeled the entire thing, to show you how our monetary system really works, and how it drives the country, inflates prices and ultimately puts you in debt. But in order to fully understand how we got to this point, we need to go back to a time before money.

History of money

If a farmer thousands of years ago needed a new tool, he’d go to the local toolmaker to buy one. The farmer didn’t have anything to give him in return, so instead, they both just agreed that he owed him something in the future. Because the toolmaker trusted the farmer, his promise of future value was an acceptable form of payment.

Sure enough, two weeks later the farmer came back and gave him some food from his farm. This type of informal transaction happened all the time, but it was slow and relied on the farmer eventually having something that the toolmaker needed, which wasn’t always the case.

To make transactions easier, people started to pay using more commonly used items, like cattle, grain and salt. Everyone needed these things, but they were hard to come by, and that’s what made them valuable. The farmer could now buy a tool and pay for it right away, using a precise amount of grain that seemed like a fair exchange.

This made transactions quicker, and both parties would leave with something valuable to them. But eventually, the demand for trade was too much, and paying with a random mix of bulky objects wasn’t good enough.

Gold and silver coins

People eventually settled on using metal coins like gold and silver, since they were small, extremely valuable and would last forever, unlike cattle or grain. Suddenly, trade around the world opened up, and things were being bought and sold all the way from China to Europe. But once again, the demand for trade became too much, and traveling with so much gold became heavy and dangerous. This is when the whole idea of money started to change.

Goldsmith money loans

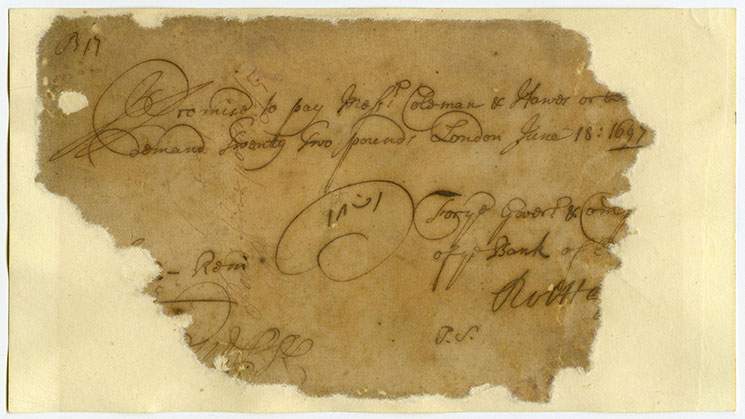

In 17th century London, trusted goldsmiths started to take in people’s gold coins, promising to look after them for a small fee. In return, they would give the customer a piece of paper: a promise note, that allowed them to retrieve their gold at any time. The key to this piece of paper was that the customer could go to any goldsmith, in any town, and claim back that exact amount of gold. The paper itself had no intrinsic value, but it became as good as gold.

The notes were so convenient that people started simply exchanging them to buy and sell things. The goldsmiths realized that most people weren’t actually coming to retrieve their gold, and so they started loaning out fake promise notes to customers: instant money that had to be paid back with interest, making the goldsmiths a small profit.

This was fake money that didn’t actually come out of their gold supply. If a goldsmith loaned out 100 coins, they wouldn’t become 100 coins poorer. They’d simply write the customer a fake note that was worth 100 coins, which could be spent anywhere.

Eventually, the customer would pay back the loan, plus the fee, making the goldsmith 105 coins richer. On top of that, the customer would spend their money by paying someone for goods, making them richer. From that single loan, the total money in existence increased by 100, yet no new coins were produced.

This meant that more money was in people’s hands than actually existed. As long as everyone didn’t come to cash in their notes at the same time, everything would be fine. If we replace the goldsmiths with banks and the promise notes with digital money, we have today’s system of money.

Why we need to create new money

When the 17th century goldsmiths started handing out fake money, it had a profound effect on the economy. Before, no new money could enter the system, and so the money that did exist was simply passed around in a cycle whenever a transaction was made. But this system had a major flaw.

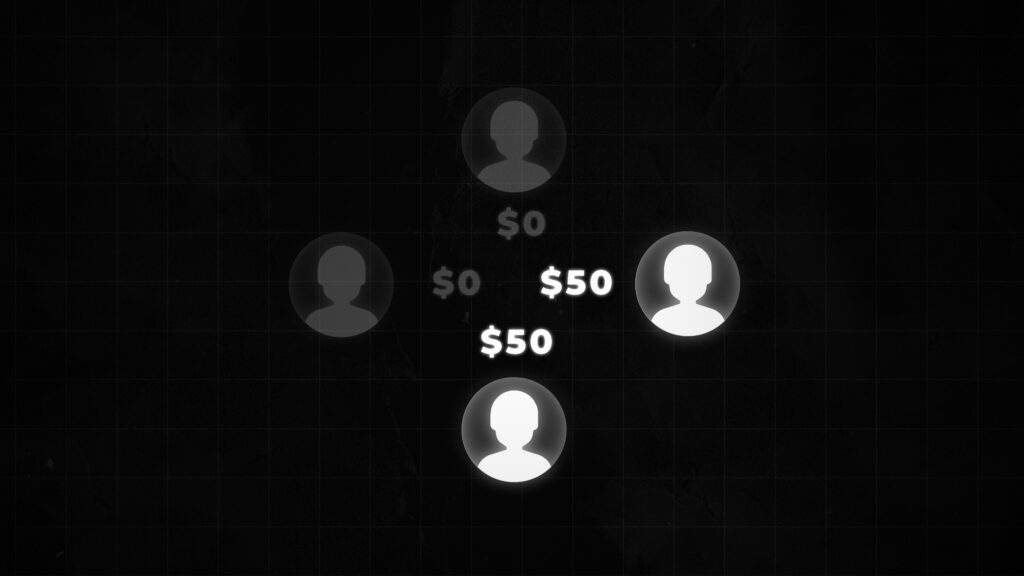

Imagine a group of 4 people who have a total of 100 dollars between them. If person 1 pays person 2 for some food, it moves the money around, making it uneven. Then, person 2 pays person 4 for a service, and the money moves again. Note that every time money is passed around, value is made and productivity grows.

But eventually, the money supply becomes uneven, and less people can participate, slowing down trade and reducing productivity. This system only works if everyone pays each other the exact same amount at the exact same time, something that is impossible in the real world.

By adding more money into the system, it speeds up the economy, allowing businesses to grow, products to be made and ultimately advances our civilization. And so a constant flow of new money is crucial in our current system. But how is this actually done?

How money is created

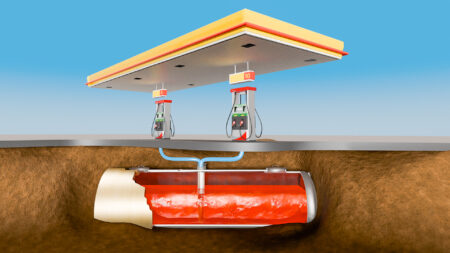

We think of banks as places that store our money and keep it safe, but that’s not really what’s going on. When you give a bank your money, they are in debt to you. The numbers you see in your bank account aren’t real wads of cash sitting in a vault – they are simply promise notes, showing that the bank owes you money, and that you can claim it back whenever you want.

A loan is exactly the same, but in the opposite direction. When banks lend us money, we are in debt to them, and we have to pay them back. This is where money really gets made.

Just like the goldsmiths, when a bank gives out a loan, they don’t get poorer, they simply type new money into your bank account. It’s brand new money that didn’t exist before. The only difference is that when you pay it back, the money gets canceled out, and the bank only keeps the interest.

But with that loan, you paid for a new car, and that money eventually made its way to the employees at the dealership. They then spent that money, and it continued to create hundreds of new transactions, powering businesses, creating new technologies, and providing us with food. All of this value and productivity would never have happened if new money hadn’t entered the system.

Inflation

The problem is that productivity doesn’t necessarily increase when we create new money, and that can cause inflation. If society starts producing less goods, but more money is added into the system, prices will go up, since there is more competition for fewer goods. Because of this, banks have to limit how much money they create. In the past, they could only lend out a portion of the actual cash they had in their backup supply.

Nowadays though, banks have almost complete freedom to create as much money as they like. If they are running low on backup money, they can simply go to the central bank and ask for more money. And that’s where things get ridiculous.

US national debt

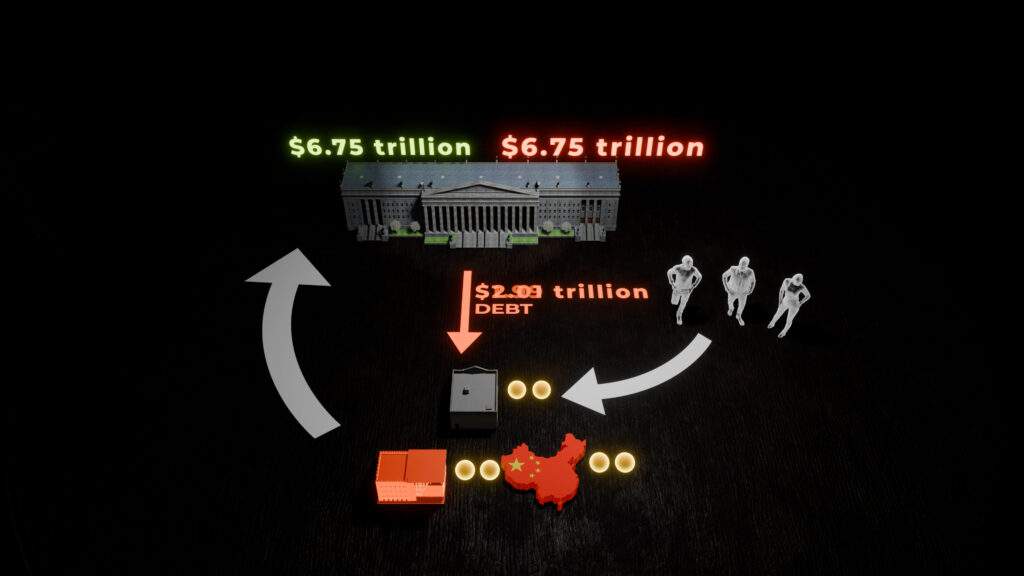

To create new money, the government creates a bond, which is essentially a loan that provides a steady income. Banks, corporations and foreign countries buy these bonds from the US government and this influx of money goes towards the government’s budget. The government uses this money to pay companies and people, and it eventually makes its way back to the banks.

The problem is, the US government almost always spends more money than it makes, so it is constantly in debt to those that buy bonds. In order to pay for that debt, it uses the tax payers money. Last year, the government spent almost 7 trillion dollars, but your tax money wasn’t enough to pay for this, and so the government had to create new bonds to receive more money, putting it further in debt, and the cycle continues.

As crazy as it sounds, this system of adding more and more money through debt is how most of the world operates. It isn’t necessarily a bad system, it’s just not running anywhere near maximum efficiency. If banks created money for more productive things like businesses, education and infrastructure, all of this money going into the system could give us higher returns in the long run.